New SIPRI arms transfers data shows small overall increase in global trade, but huge increase in sales to the Middle East.

The Stockholm International Peace Research Institute (SIPRI) yesterday releasedits latest data on the global arms trade, for which it is by far the best source. The data provides details of deliveries of major conventional weapons worldwide from 1950-2018, both in numerical terms and with searchable lists of the actual weapons transferred between countries. The information can be found in SIPRI’s database, and some of the key points are discussed in a fact sheet also published yesterday.

The headline figure shows that worldwide arms transfers over 2014-2018 were 7.8% higher than the previous 5-year period, 2009-2013. The pace of growth is slowing, though, and the “5-year moving average” is barely changed compared to 2013-17.

A couple of points that always need to be made about SIPRI arms trade data:

* First of all, it only covers major conventional weapons, so not small arms and light weapons, and not most components and sub-systems, although it does include engines for aircraft, ships, and military vehicles, and radar systems.

* Second, it does not measure the financial value of the arms trade, but SIPRI’s own “volume” measure of arms deliveries, the Trend Indicator Value (TIV). The idea of the TIV is to give the same value to weapons systems with roughly similar capabilities, using the unit costs of US weapons systems as a baseline. This gets round the problem that we don’t always know the price of every major arms deal, as this is not always made public.

More detailed information on the TIV measure and SIPRI’s methodology can be found here.

The US is by far the biggest arms seller, as they have been since the fall of the Soviet Union, with 36% of the global market in 2014-2018, followed by Russia with 21%, far ahead of France, Germany, and China, with 6.8%, 6.4%, and 5.2% respectively. Compared to 2009-2013, the US share has gone up while Russia’s has gone down. France’s share is also up a bit.

The UK is in 6th place, with 4.2% of global arms sales, slightly down on 2009-2013. If this sounds surprisingly small, it’s because a large proportion of the UK’s arms sales involve components and subsystems, as well as military services; such as those BAE Systems provides to Saudi Arabia with its 6,000 employees there, supporting the Saudi Air Force as it bombs Yemen. These do not figure in the SIPRI data. In financial terms, the UK is probably the third biggest arms seller, after the USA and Russia.

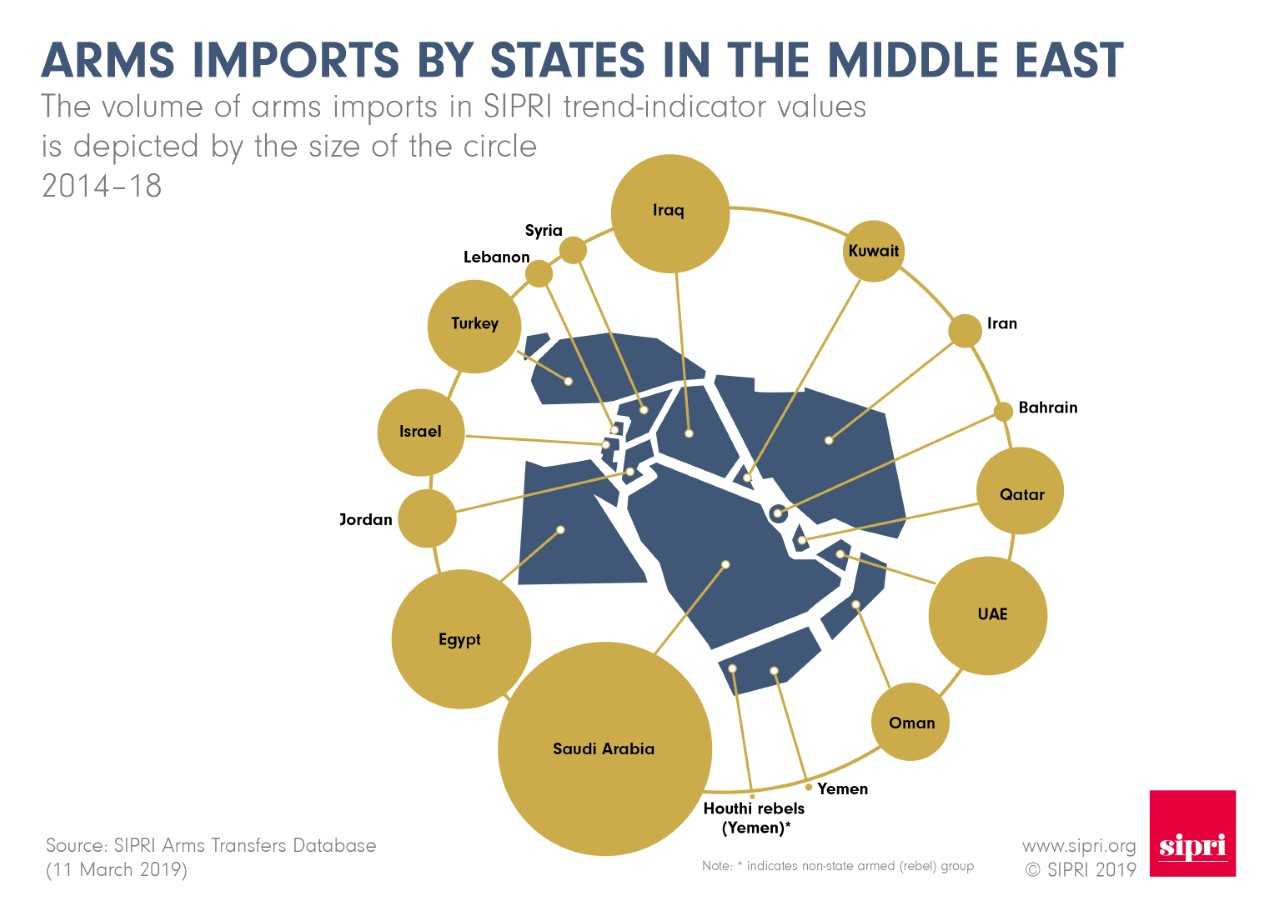

If the top line numbers aren’t a huge change from before, there has been a significant shift in where the big buyers are. In previous years, India and China have been the biggest arms importers. Now, the states of the Middle East have been buying arms at breakneck pace, fuelled by the brutal wars in Yemen and Syria, rising tensions between Iran on the one hand and Israel and the Gulf monarchies on the other.

The biggest buyer of all in 2014-2018 was Saudi Arabia, with 12% of all arms imports worldwide, bought mostly from the USA and Britain, but also France. Under its unstable and murderous Crown Prince Mohammed bin Salman (MBS), the Kingdom has been flexing its regional muscles, bombing and blockading Yemen into a humanitarian catastrophe, kidnapping the Lebanese Prime Minister in an attempt to overthrow its government, and picking what even Saudi Arabia’s western supporters consider to be a completely pointless fight with Qatar. (Though this squabble has been great for western arms industries; to shore up its alliances in the face of the Saudi threat, Qatar has ordered three different types of fighter aircraft from three separate sellers: the USA, France, and the UK).

India is number two in the list behind Saudi, with Egypt 3rd, and the UAE and Iraq are also in the top 10. Iraq more than doubled its arms imports since 2009-2013, Saudi Arabia, Egypt, Qatar, and Oman have all roughly trebled theirs, while Israel and Kuwait have more than quadrupled them.

Overall, during 2014-2018, the Middle East received 35% of the world arms trade, compared to just 20% in 2009-2013. The region is home to just over 5% of the world’s population, but a combination of wars, illegal occupation, oil, autocratic regimes, and the opportunities big arms deals present for massive corruption, combine to create an insatiable demand for arms; and the world’s big arms producers, keen to maintain influence in a strategic region, gain access to oil wealth, and sustain their own arms industries, are all too eager to feed this arms race, regardless of the consequences.

Of all the top 10 arms exporters, the UK was the most dependent on the Middle East market, with 59% of UK exports going to the region. It is probably true to say that, without its reckless and unprincipled exports to the Middle East, large parts of the UK arms industry would cease to be viable, or at least would need far more money spent on them by the government than is already the case to prop them up.

Successive UK governments have insisted that a strong national arms industry is essential to the country’s “security” – so to keep it going, they continue to feed this lethal and highly destabilizing Middle East arms race, creating massive insecurity first for the people of the region, but also for the wider world, including the UK itself.

We need a much better idea about what “security” actually means.