UK governments often like to boast of the UK’s “special relationship” with the US. How central this relationship really is to the US is debatable, but one area where cooperation between the two countries is particularly close is in the arms industry and trade. Each is a significant supplier of arms to the other, they are engaged in major collaborative arms programmes, most notably the F-35 stealth fighter aircraft, and the major UK arms companies have large subsidiaries in the US, and vice versa.

UK arms sales to the US

While the US sources most of its arms from US-based arms companies, it is also a significant importer, the 13th biggest worldwide between 2016-20, according to SIPRI data for major conventional weapons transfers. The UK was the largest supplier of such weapons, accounting for 22% of US imports.

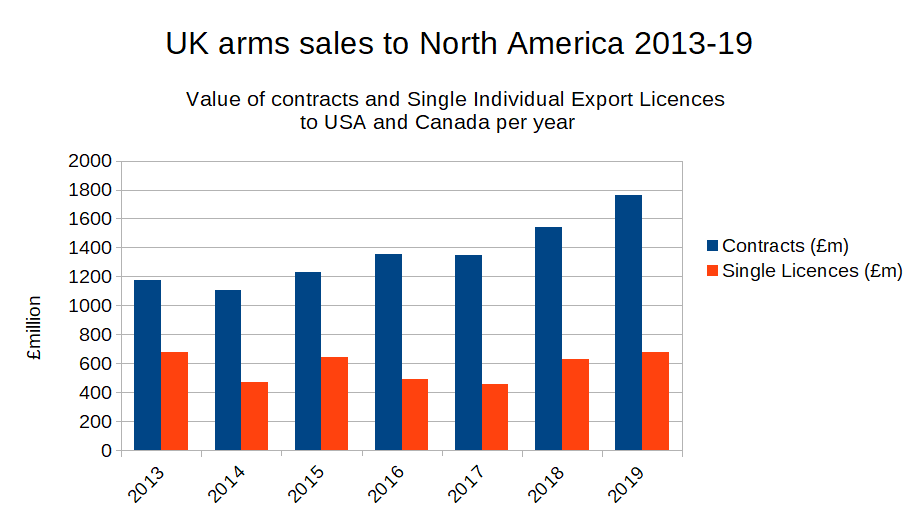

However, as a large proportion of UK arms trade in general consists of subsystems, components, and services, not counted by SIPRI, this only tells part of the story. Between 2015 and 2019, the UK sold £7.2 billion worth of arms to the US and Canada combined, of which the vast majority will be to the US. This makes the US the UK’s second largest arms customer after Saudi Arabia.

These figures are based on the value of arms contracts won by UK companies, collected by UK Defence and Security Exports. (Figures for individual countries are not made public). Over the same period, the UK issued standard (Single Individual) export licences for arms sales to the US worth only £2.8 billion (and, for comparison, just £112 million to Canada), but the majority of UK arms sales to the US are made using the secretive open licencing system.

The UK-US Defence Cooperation Treaty in particular means that the process of gaining permission to sell arms between the two is greatly simplified and eased. In the UK, this takes the form of an Open General Export Licence (OGEL), for which companies can register, and which then, subject to certain conditions and record-keeping, allows them to sell a very wide range of military equipment, technology, and services to the US without the need for specific permits for each sale. Once a company is registered for this OGEL, this permission lasts indefinitely.